Property Owners Subcontractors and General Contractors opt for builders risk insurance to financially protect themselves from unexpected incidents. Purchasers of Builders Risk insurance coverage need to think about more than just the cost of the policy.

Builder S Risk Insurance Course Of Construction Insurance Insureon

There are typically two parties that may purchase and carry a builders risk insurance policy.

. The Hartford is one of the most financially stable companies offering builders risk insurance. Who Pays for Builders Risk. Individuals or entities including contractors business owners homeowners or financial institutions are often your primary builders risk clients.

General Contractors Insurance General contractors. Builders risk insurance is a type of property insurance that protects projects that are not yet completed. Although there are quite a few people who can be included in your Builders Risk insurance there are only a few who typically buy it.

Connect with an Expert Advisor. So for example if the construction budget is 200000 you will likely end up spending. Builders risk insurance is a type of property insurance that protects projects that are not yet completed.

We have been told by three different insurance agents that as the property owners paying cash that we should have the. The limit must accurately reflect the total completed value of the structure all materials and labor. The residential builders risk insurance policy will pay for damages up to the coverage limit.

Founded in 1810 it is also one of the oldest insurance companies in the US. For example if a bad storm destroys a project while it is in progress builders risk. The property owner should purchase builders risk insurance but the general contractor can also purchase it depending on the.

A general contractor or the project owner. Who pays for builders risk insurance. We will be paying cash and have gotten quotes from three builders.

The onus of paying for the builders risk insurance policy usually falls on one of these two parties because they tend to have the most stake in these kinds of projects. Who pays for the Builders Risk Insurance Policy. As a general rule of thumb expect to pay.

Who pays for the. For example if a bad storm destroys a project while it is in progress. Builders risk insurance typically costs 1 5 of the total construction project budget.

Builders risk policies are common insurance policies during construction or renovation and are most often purchased. Who Pays For Builders Risk Insurance and Who Should Be Insured. When insurers are asked by clients how much they can expect to pay for builders risk.

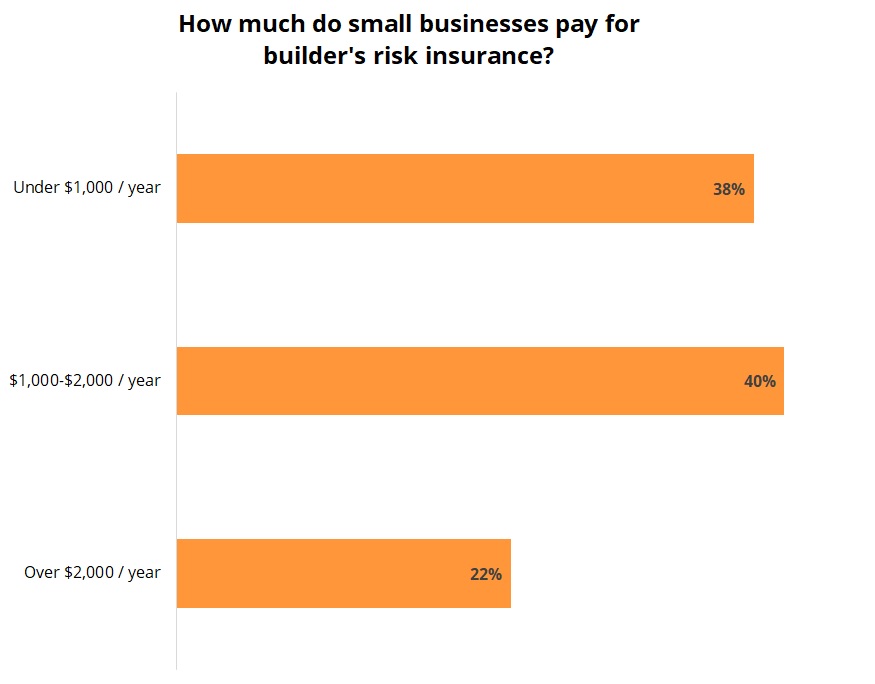

Builders risk insurance cost depends heavily on both the specific coverage of the policy and the circumstances of the project. The experience level of the contractors and subcontractors involved in the project. It is all about who is taking on the risk.

Builder S Risk Insurance Course Of Construction Insurance Insureon

How Much Does Builders Risk Insurance Cost Commercial Insurance

Who Pays For A Builders Risk Policy

Do You Have Workers Comp Call Us Today At Toll Free 1 833 682 61 62 And Visit Our Web Beeinsured Co Disability Insurance Business Insurance Disability

Who Pays For A Builders Risk Policy

Builder S Risk Insurance Do Property Owners Or Contractors Buy It Blue Rock Insurance Services

Different Types Of Business Insurance Uk Insurancesquare Business Insurance Business Risk Business Protection

Do Contractors Need Builder S Risk Insurance

Do You Need Hazard Insurance And Homeowners Insurance Hazard Insurance Homeowners Insurance Homeowner

Builder S Risk Insurance Cost Insureon

What Does Builder S Risk Insurance Cover Forbes Advisor

How A Builder S Risk Insurance Policy Can Protect Your Business Insureon

Builder S Risk Insurance Ontario What Is Covered Apollo Insurance

Builder S Risk Insurance Do Property Owners Or Contractors Buy It Blue Rock Insurance Services

What Is Builder S Risk Insurance And Who Should It Cover North American Underwriters

Who Pays For Builder S Risk Insurance Rob Freeman

What Is Builder S Risk Insurance The Hartford

Medical Payments Coverage Pays Medical Expenses Up To A Specified Dollar Limit For You And Passengers Of Y Florida Insurance Car Insurance Personal Insurance